Business

FINANCIAL LITERACY DRIVE

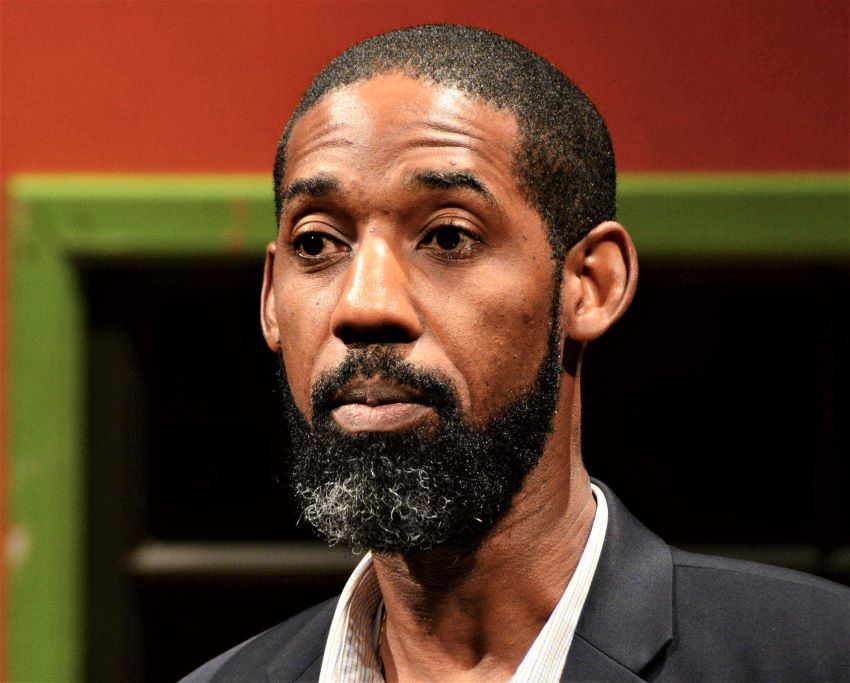

Government is intensifying its efforts to educate citizens about financial literacy, in an attempt to ensure they improve their money-management skills, and make better financial decisions. And, Consultant to the Financial Literacy Bureau and “FLB Champion”, David Simpson, said this sensitisation targets every citizen/resident of Barbados, regardless of age, gender, academic, or professional background.

Mr. Simpson emphasised the importance of financial literacy, saying it was critical to our future development as a people, and country. Therefore, he said, officials at the Financial Literacy Bureau (FLB) “will not stop until the objective has been achieved”.

Even children, the FLB Champion pointed out, will be brought into the loop, so they too will be armed with the necessary information to make good financial decisions with regards to any money they receive.

“The Financial Literacy Bureau has been working with the Ministry of Education and other community stakeholders to have our programmes included in each school’s activities.

“More importantly, we are working to have the school curriculum updated to reflect elements of financial literacy and money management being taught to our children from as early as nursery level, right up to university,” he disclosed.

In addition, Mr. Simpson said officials at the FLB had already consulted various community groups, and were actively preparing customised programmes for their members. He noted that the Bureau had also delivered financial literacy interventions for a few corporate entities and other social/community groups over the past six months.

Financial literacy refers to individuals possessing skills and knowledge on financial matters that enable them to confidently take effective action that best fulfils their personal, family, business, and community goals. Several countries across the globe have also introduced financial literacy programmes to help their citizens manage their personal finances.

Financial literacy refers to individuals possessing skills and knowledge on financial matters that enable them to confidently take effective action that best fulfils their personal, family, business, and community goals. Several countries across the globe have also introduced financial literacy programmes to help their citizens manage their personal finances.

Mr. Simpson explained that over the years, in Barbados, it became evident, not only to Government and its agencies but also business support organisations, the banking sector and the credit union movement, that the ability of their various constituents to navigate financial transactions and related matters was not at acceptable levels.

“Financial and money matters touch every single part of our daily existence – we work to earn money; we spend that money investing, saving and consuming – so Government realised that an intervention was required.

“This intervention is based on three key pillars – the improvement of money management skills; building a strong foundation for financial decisions, and promoting the creation of an investment culture that facilitates the creation of wealth that is intergenerational,” he pointed out.

Financial experts across the world are of the view that when people understand basic financial concepts, they are in a better position to navigate in the financial system. They agree that those who receive financial literacy training make better financial decisions and manage their money better than those who do not receive such exposure.

Indeed, some members of the public who participated in the financial literacy sessions here even reported that they have been applying the information shared and are already reaping success.

Mr. Simpson noted that the response to the sessions has been “exceptional”, especially since the weekly webinars were moved to the online Zoom platform.

He said this allowed the FLB to reach more people in the comfort of their homes, offices, etcetera. “Our attendees have valued the insights, information and content shared and have been very engaged in all of our sessions to date,” he indicated.

Financial experts across the world are of the view that when people understand basic financial concepts, they are in a better position to navigate in the financial system. They agree that those who receive financial literacy training make better financial decisions and manage their money better than those who do not receive such exposure.

He said the Barbadian population has been segmented into a few niche groups, namely households; businesses (especially small business and entrepreneurs); children (school aged and tertiary institutions), and community groups/non-governmental organisations, to ensure the sessions are effective.

Some of the areas being covered during the webinars are: Introduction to Savings and Investment; Managing Your Credit Cards; Retirement Planning; Understanding Social Security, NIS and Pension Benefits; Estate Planning – using Wills, Trust, etc.; Costing and Pricing of Products and Services, and Managing Your Credit Rating.

The FLB Champion pointed out that the course catalogue will be revised, so more courses will be available for attendees.

And, for those people who believe they are good at managing their finances, and may not need the training, Mr. Simpson reminds: “There is always room for improvement, so you can do better at financial management. This will translate to more savings, more investments, better consumption practices, as well as more focus on financial and other goals.”

Several small businesses have been impacted severely as a result of the COVID-19 pandemic, and the FLB Champion is encouraging entrepreneurs to join the FLB’s sessions, and receive valuable tips to help them transform their businesses.

“As with any crisis, self-reflection and analysis are important. COVID-19 mandated that we reassess how we conducted our business, how we used technology, as well as how we interacted with our customers and clients.

“This was necessary not only from a health perspective but also in terms of ensuring sustainability and future viability, as consumer spending habits and tastes were forcefully changed,” he stated.

One thing is clear, we have not been able to stretch our dollars like our grandparents did in the past. And, with the rising cost of living because of internal and external factors, the glimmer of hope seems to be fading.

However, if we take advantage of the financial literacy training being offered, we can put ourselves on the path to storing up that nest egg, not only for ourselves, but our children, thus creating that opportunity for intergenerational wealth. (PR/GIS)