by Deanzer Roberts

There was a sense of renewed purpose in the air on May 30 as CIBC Caribbean brought together staff, stakeholders and community leaders both in person and online for the long-awaited relaunch of its beloved Unsung Heroes programme.

Held at the bank’s regional Head Office, the event marked the return of a signature initiative that once captured hearts across the region from 2003 to 2013. Now, more than a decade later, the campaign is back—refreshed, reimagined, and reaffirmed in its mission to spotlight the quiet champions of Caribbean society.

Delivering the keynote address was Donna Wellington, Chief Country Management Officer, who warmly reflected on the “immense goodness and kind acts” unearthed during the original programme’s tenure. She expressed excitement at the prospect of again discovering individuals who, though unheralded, are transforming lives through service, kindness, and courage.

With its original foundation rooted in honouring selfless men and women, the revitalised campaign expands the lens to include young people aged ten and above. According to Wellington, many of the region’s youth are actively engaged in positive, socially conscious efforts—ranging from environmental activism to community health awareness—but often go unrecognised. The new campaign seeks to change that.

Under the updated format, persons can be nominated for their outstanding work within their communities or for acts of heroism, bravery, or extraordinary kindness within the 12 months prior to the start of the campaign. The initiative will run across all ten territories where CIBC Caribbean operates, culminating in the announcement of local winners in August and regional awardees in September.

Wellington noted that the programme would once again be a key initiative under the CIBC Caribbean ComTrust Foundation, the charitable arm of the bank. She acknowledged the trustees of the Foundation for their enduring commitment to community development and expressed particular thanks to Debra King, the longest-serving trustee, for her guidance and leadership since the Foundation’s inception.

Established in 2003, the ComTrust Foundation has become a critical force for good across the region, disbursing over US$32 million—or approximately BDS$64 million—towards projects in areas such as health, education, youth development and environmental sustainability. From scholarships at the University of the West Indies to after-school programmes with the YMCA, the Foundation’s reach has been broad and impactful. It has supported young entrepreneurs through Youth Business Trusts and partnered with organisations like Hands Across the Sea to promote literacy in the OECS.

The Foundation has also stepped in during times of crisis. From supplying PPE during the COVID-19 pandemic to assisting in the aftermath of Hurricane Beryl and the La Soufrière volcanic eruption, its commitment to regional resilience has been unwavering.

One of its flagship initiatives, Walk for the Cure, continues to grow in popularity, attracting over 35,000 participants last year and raising more than US$5 million to support cancer care across the Caribbean.

Wellington also used the occasion to touch on the bank’s transformation journey. She described CIBC Caribbean as a more agile and digitally focused institution, offering customers a modern, secure and user-friendly banking experience. The bank, she said, remains deeply connected to the communities it serves, committed not only to financial innovation but to people-centred development.

As the event closed, anticipation was high for what the next generation of Unsung Heroes would bring. With nominations soon to open, the relaunch signaled more than the return of a programme—it marked a reaffirmation of Caribbean compassion, character, and community spirit.

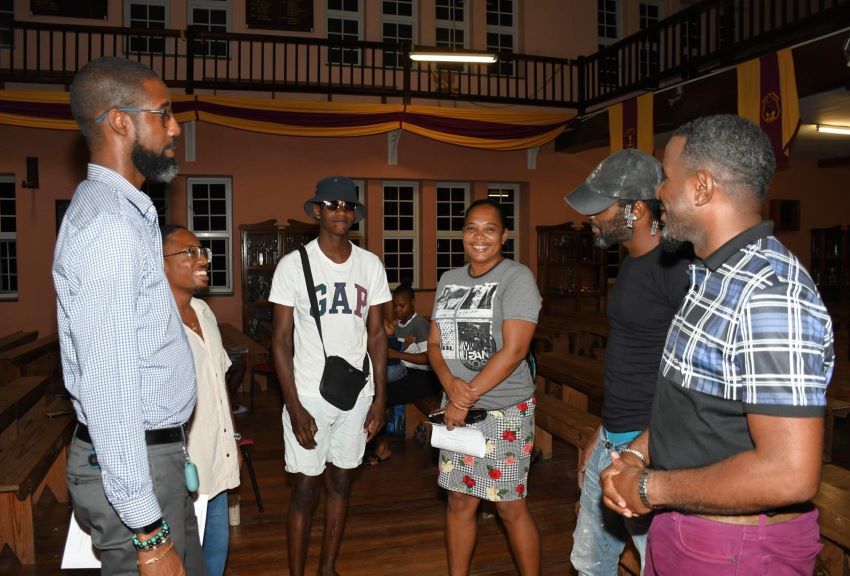

Caption (from left to right) Corporate Communications Manager, CIBC Caribbean, Anthony Blackman, Chief Country Management Officer, Donna Wellington, Corporate Communications Manager, Debra King, Associate Senior Counsel and Trustee of the CIBC Caribbean ComTrust Foundation Olivia Burnett and Secretary to the ComTrust Foundation Shantelle Griffith looking at the coffee table book Unsung Heroes of the Caribbean featuring past winners of the bank’s Unsung Heroes programme.

Local1 week ago

Local1 week ago

International3 weeks ago

International3 weeks ago

Tourism2 weeks ago

Tourism2 weeks ago

Business3 weeks ago

Business3 weeks ago

Government2 weeks ago

Government2 weeks ago

Sports1 week ago

Sports1 week ago

Local3 weeks ago

Local3 weeks ago

International3 weeks ago

International3 weeks ago